Offshore Company Management for Dummies

Wiki Article

A Biased View of Offshore Company Management

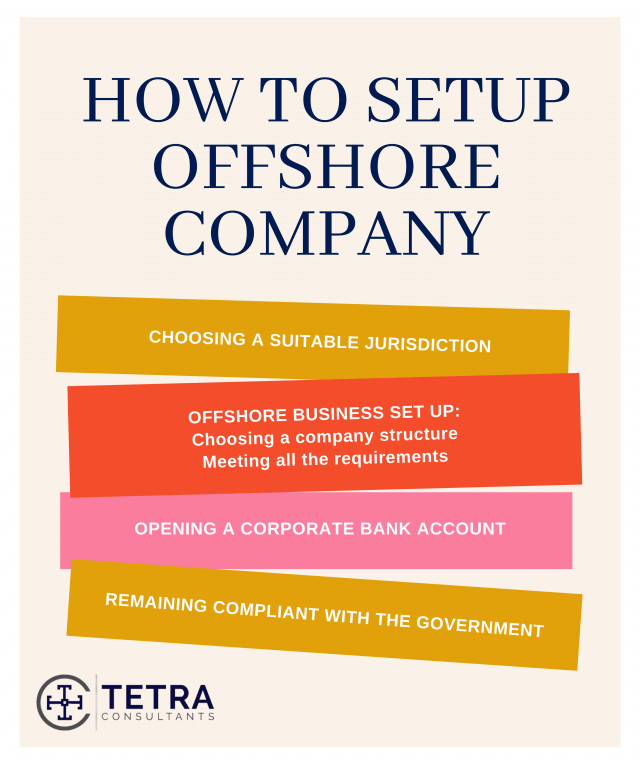

Table of ContentsUnknown Facts About Offshore Company ManagementGetting My Offshore Company Management To WorkFacts About Offshore Company Management UncoveredThe Offshore Company Management Diaries

This is since the company is registered in a different territory that is usually beyond the reach of tax obligation authorities or rivals. If you are in the US, but register the firm in a territory like Seychelles or Belize, you can rest guaranteed that your data is safe.Establishing up an overseas business offers lots of tax obligation benefits considering that they are excluded from the greater tax obligations that onshore firms have to pay. You will certainly not go through the very same tax obligation prices as residential firms, so you can conserve a good deal on tax obligations. The jurisdictions where overseas firms are commonly signed up often have double taxation treaties with other countries.

An offshore company is likewise more flexible regarding regulations and also conformity. The legislations in the territory where you register the business may be much less stiff than those in your home country, making it much easier to establish up the company and also run it without excessive paperwork or legal headache. You will certainly also have fringe benefits, such as utilizing the business for worldwide profession.

This is since the company is registered in a jurisdiction that may have extra flexible property security regulations than those of your house country. If you select the right jurisdiction, creditors can not easily take or freeze your overseas assets. This makes sure that any kind of cash you have bought the business is secure and also secure.

All about Offshore Company Management

Offshore business can be made use of as lorries to secure your assets versus potential plaintiffs or financial institutions. This indicates that when you pass away, your beneficiaries will inherit the properties without disturbance from financial institutions. Nonetheless, it is necessary to consult an attorney prior to setting up an overseas firm to make sure that your possessions are correctly protected.Offshore territories typically have easier needs, making finishing the registration process as well as running your service in no time a wind. Furthermore, most of these territories supply online consolidation services that make it a lot more hassle-free to sign up a firm. With this, you can promptly open a service checking account in the jurisdiction where your business is signed up.

Setting up an offshore business can assist decrease the chances of being sued. This is since the laws in numerous territories do not allow international firms to be taken legal action against in their courts unless they have a physical visibility in the country.

The Buzz on Offshore Company Management

Some of the benefits of an offshore business include tax obligation benefits, privacy as well as privacy, legal defense and property security. In this blog site we will look at what an overseas company is, positions to consider for optimal tax obligation benefits and also offshore incorporation as well as set up.

Lots of countries provide tax obligation benefits to companies from various other nations that relocate to or are incorporated within the jurisdiction. Firms that are created in these overseas territories are non-resident due to the fact that they do not perform any kind of financial purchases within their visit this web-site borders and are had by a non-resident. If you wish to establish up an overseas firm, you should use a consolidation representative, to make sure the paperwork is finished properly and you get the very best advice.

Examine with your development agent, to ensure you don't damage any kind of limitations in the nation you are creating the firm in around safeguarded firm names. Take into consideration the kinds of shares the business will issue.

Offshore Company Management Things To Know Before You Buy

Offshore organization frameworks might hold a special condition that makes them non reliant local domestic tax obligations or are called for to pay taxes on their around the world earnings, capital gains or revenue tax. offshore company management. If your overseas company is importing or exporting within an offshore area, as an example, obtaining orders straight from the client and also the bought items being sent out from the manufacturer.

For UK homeowners, provided no quantities are paid to the UK, the funding and also income gained by the overseas firm continue to be tax-free. Tax obligation commitments usually are figured out by the nation where you have permanent residency in and as valuable owners of a business you would certainly be reliant be taxed in your nation of house - offshore company management.

Tax obligations differ considerably from country to nation so its important to ensure what your tax obligation obligations are prior to selecting a jurisdiction. Offshore companies are only internet based on UK tax on their profits occurring in the UK. Also UK source returns paid to an overseas business needs to be without tax obligation.

Report this wiki page